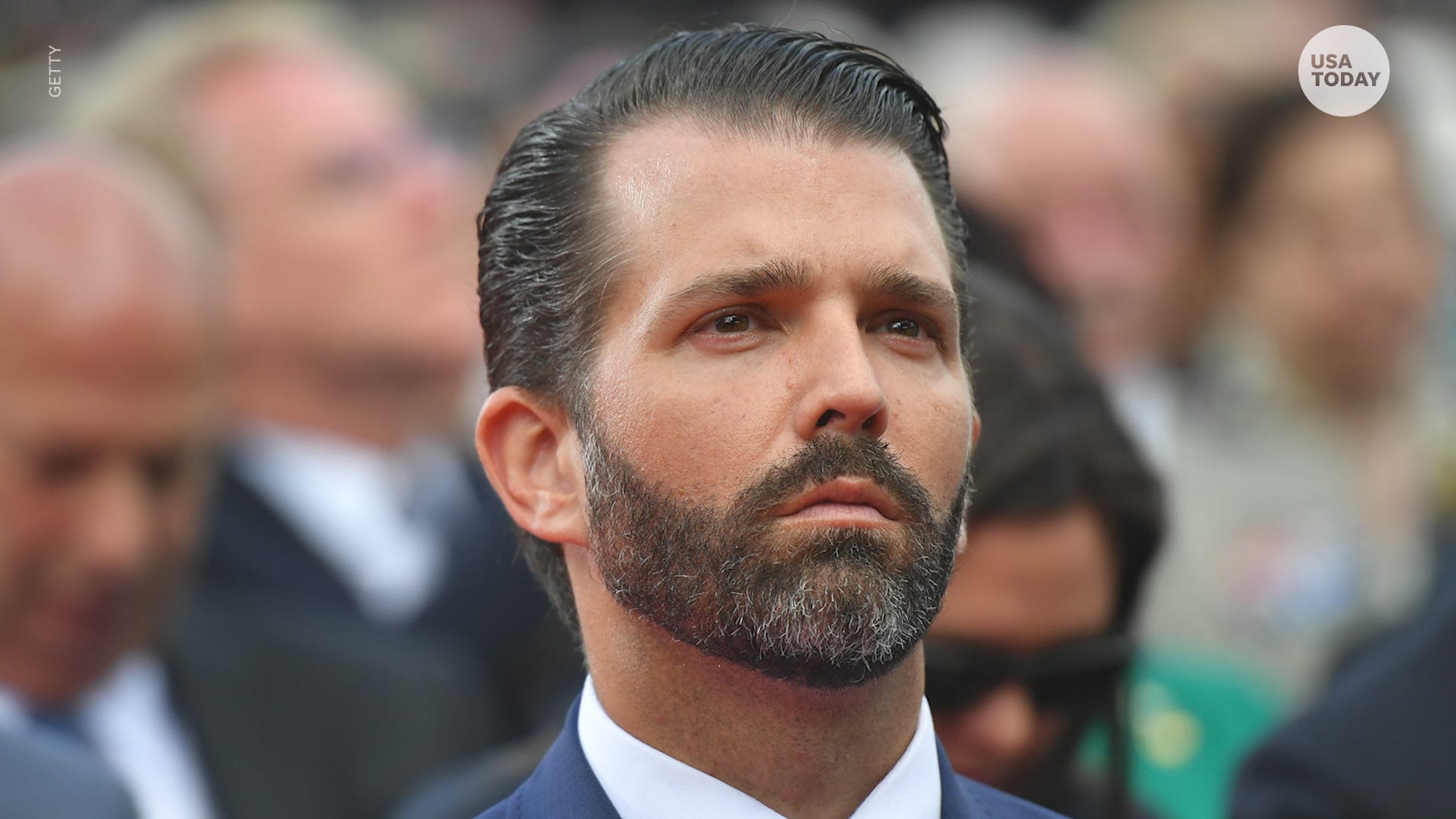

Donald Trump Jr. Net Worth 2023: A Deep Dive

How much is Donald Trump Jr. worth? Understanding the financial profile of a prominent public figure.

Donald Trump Jr.'s financial standing is a matter of public interest given his prominent role in the business world and his family's well-known influence. Assessing an individual's financial assets is complex and often estimated rather than precisely quantified. Factors such as investments, business holdings, and income streams contribute to the overall evaluation. Information regarding wealth is usually compiled through a variety of sources, including financial disclosures, publicly available records, and expert estimations. It's crucial to remember that these figures can fluctuate and may not reflect the full complexity of financial situations.

Understanding a figure like Donald Trump Jr.'s financial standing provides insights into the influence of wealth in various sectors, such as business, media, and politics. The accumulation and management of wealth often involve significant investments, business ventures, and financial strategies, which can inform wider economic analysis. Understanding this also helps in considering various aspects of their influence and actions, particularly in areas like public discourse or business transactions. The absence of detailed public disclosure can further complicate matters and may impact the transparency surrounding their financial activity.

| Category | Details |

|---|---|

| Known Business Involvement | Various business ventures, including real estate and related investments. |

| Public Profile | Prominent role in the business world and political sphere. |

| Potential Sources of Income | Business operations, investments, and potential speaking engagements. |

| Information Availability | Information may be limited or incomplete concerning specifics of wealth or earnings, due to private financial holdings. |

This information serves as a preliminary overview. Further analysis of specific aspects of Donald Trump Jr.'s business endeavors and assets would be necessary to delve deeper into the nature and dynamics of his financial portfolio.

Donald Trump Jr. Net Worth

Evaluating Donald Trump Jr.'s net worth requires careful consideration of various financial factors. Public estimation is often based on available information, but precise figures remain elusive.

- Business ventures

- Investment portfolio

- Income streams

- Asset valuation

- Public disclosures

- Estimate fluctuations

- Privacy considerations

- Family influence

Donald Trump Jr.'s business involvement, including real estate and potentially other ventures, significantly influences his net worth estimations. Fluctuations in the market, and the nature of private investments, impact these estimates. Public disclosures, when available, offer some transparency; however, the absence of extensive public records often necessitates estimates. Family ties and public prominence can also contribute to the complexity of evaluating his financial standing. Understanding the varied factors involved in arriving at this figure highlights the complexities of quantifying a public figure's wealth.

- Floretjoy Chaturbate Content Free Videos Live Streams

- Amber Stevens West Latest News Updates You Need To Know

1. Business Ventures

Business ventures undertaken by Donald Trump Jr. represent a significant component in evaluating his net worth. The success or failure of these ventures directly impacts the overall valuation. Successful ventures generate revenue, increase asset value, and positively contribute to the accumulation of wealth. Conversely, unsuccessful ventures can lead to losses, reducing the overall net worth. The nature of these ventures, from real estate to potentially other business endeavors, plays a pivotal role in determining the financial standing.

Examples of business ventures influencing net worth include successful real estate investments. Appreciation in property value contributes to a higher net worth. Conversely, the failure of a business venture, perhaps due to market shifts or unforeseen circumstances, can diminish net worth significantly. The profitability of any business operation is a critical determinant of its impact on the individual's overall financial standing. The interconnectedness of these ventures with the broader economic environment adds another layer of complexity. A strong economy often fosters favorable conditions for business success, increasing the potential for accumulated wealth.

Understanding the connection between business ventures and net worth is crucial for evaluating the financial standing of any individual, particularly those actively involved in business. The impact of these ventures extends beyond simply adding to the total; it demonstrates the complexity of financial accumulation and the potential for both growth and loss. Success or failure in these ventures has a direct bearing on the overall financial status and, potentially, wider economic patterns. This evaluation necessitates considering the totality of the individual's activities, not just a single factor like income or investment.

2. Investment Portfolio

An individual's investment portfolio is a crucial component in determining their net worth. Investments, whether in stocks, bonds, real estate, or other assets, represent a significant portion of a person's overall financial standing. The value of these holdings fluctuates based on market conditions, impacting the overall net worth. A diversified and successful portfolio can lead to substantial wealth accumulation over time. Conversely, poorly managed investments can diminish a person's net worth.

The specific investments within a portfolio, and their performance, directly correlate to the net worth. For example, a successful investment in a rapidly growing company's stock can yield substantial returns, positively impacting net worth. Conversely, an unsuccessful venture, perhaps due to poor market timing or an unsound investment strategy, can lead to a decline. The overall value of the portfolio at a given point in time directly affects the calculated net worth. Real-world examples from the financial markets demonstrate the impact of portfolio performance on overall wealth. Changes in market conditions and economic factors profoundly influence investment returns, impacting portfolio value and, consequently, net worth.

Understanding the connection between investment portfolios and net worth is essential for comprehending the complexities of personal finance. A well-managed investment portfolio, aligned with long-term financial goals, is an important aspect for achieving sustained financial stability and wealth creation. The value of investments, subject to fluctuations, is a dynamic factor in overall net worth calculation. This understanding is critical for individuals seeking to manage and grow their financial assets effectively. Analyzing investment strategies and their impact on net worth is part of the broader discourse on financial planning and wealth management.

3. Income Streams

Income streams are fundamental in determining an individual's net worth. Understanding the various revenue sources contributing to Donald Trump Jr.'s financial position is crucial for a comprehensive evaluation. These sources can include business operations, investments, and other potential income streams, all playing a role in the overall wealth calculation.

- Business Operations

Revenue generated from active business operations, such as real estate development, business ownership, or related ventures, directly affects net worth. Profitability and the scale of these operations are key indicators. Successful ventures yield substantial income, thereby increasing net worth. Conversely, struggling ventures can reduce income and potentially lower net worth.

- Investments

Investment returns, stemming from stocks, bonds, or other financial instruments, are a vital component of income streams. Returns on these investments contribute to the overall revenue and, consequently, to the accumulation of wealth. The types of investments, their performance, and the diversification of the portfolio all play crucial roles.

- Royalties or Licensing Fees

Earnings from intellectual property, licensing agreements, or similar sources might also be part of income streams. The value of such assets and their potential for ongoing revenue generation directly correlate with potential increases in net worth. Specific examples would be needed to evaluate their impact.

- Speaking Engagements and Appearances

Public appearances, speaking engagements, or other professional engagements can generate substantial income. The number of appearances, fees charged, and associated marketing can impact income. Details on this type of income would influence an evaluation of net worth.

The multifaceted nature of income streams underscores the complexity of evaluating Donald Trump Jr.'s net worth. Each stream, influenced by factors like business success, market conditions, and the individual's investment strategies, contributes to a dynamic calculation. Analyzing these different streams provides a more nuanced understanding of the factors influencing his overall financial standing.

4. Asset Valuation

Accurate asset valuation is critical in determining Donald Trump Jr.'s net worth. This process involves assessing the market value of various assets held by the individual, and this valuation directly impacts the calculated net worth. Fluctuations in asset values can significantly alter the overall financial picture. This complexity underlines the need for detailed analysis of individual assets within the portfolio.

- Real Estate Valuation

Real estate holdings, a potential component of Trump Jr.'s assets, require specialized appraisal methods. Market conditions, location, property size, condition, and comparable sales data all influence valuation. Changes in these factors over time can drastically alter the market value of a property. For example, a prime location property might appreciate significantly while a property in a declining neighborhood might decrease in value, mirroring wider economic trends. This underscores the dynamic nature of real estate valuations, making them a core part of a complex net worth calculation.

- Investment Asset Valuation

Investments in stocks, bonds, or other financial instruments must be valued based on current market prices. These valuations can fluctuate significantly based on market sentiment, economic news, and company performance. For example, a stock investment might increase in value based on favorable earnings reports, while the opposite can be true in case of negative news or market volatility. The overall value of the investment portfolio therefore changes according to real-time market conditions.

- Business Valuation Methods

If Trump Jr. holds a stake in a business entity, that entity's valuation must be considered. Different valuation methodologies exist, each with its own complexities, including discounted cash flow analysis, comparable company analysis, or market-based approaches. These methods are essential for evaluating the overall business worth held by the individual. Factors like projected earnings, revenue streams, and market position are used in valuation estimates. Ultimately, the chosen method affects the valuation and the estimate of net worth.

- Intangible Asset Valuation (if applicable)

Evaluating intangible assets, if any exist, such as trademarks or intellectual property, presents unique challenges. This type of valuation requires specialized expertise and is often more complex than evaluating tangible assets. For example, brand value might be estimated based on factors like market share, customer recognition, or perceived brand quality, adding another dimension to the net worth calculation. Determining the value of such assets often requires specific market analysis and industry expertise.

In summary, accurate asset valuation is not a static exercise. The value of assets is dynamic and depends on a variety of factors. These diverse valuation methods demonstrate the complexity of determining net worth, particularly for individuals involved in complex business ventures and multiple asset classes. This complexity highlights the importance of accurate assessments for a complete financial profile.

5. Public Disclosures

Public disclosures play a critical role in understanding an individual's financial standing, including the net worth of Donald Trump Jr. These disclosures, when available and comprehensive, provide transparency into the sources and nature of wealth accumulation. Public filings, financial reports, or other documented information offer insights into investments, business ventures, and income streams. This transparency allows for a clearer picture of the individual's financial profile. However, the absence of comprehensive public disclosure can impede a thorough understanding and necessitate estimations based on available information, potentially leading to varied and less precise valuations.

The importance of public disclosures stems from their role in maintaining accountability and fostering transparency, particularly in figures with significant public influence. Accurate and timely disclosures enable a more informed understanding of the financial dynamics involved. Public scrutiny encourages appropriate governance and helps ensure dealings align with established regulations. Conversely, a lack of transparency might raise concerns about potential conflicts of interest or hidden financial arrangements, potentially affecting public perception. While disclosures are crucial, their interpretation needs careful consideration, as not all disclosed information directly correlates to the full net worth. Complex financial arrangements or privately held assets may remain undisclosed, and estimations might vary widely depending on interpretation and available information. For instance, the absence of specific details on investment portfolio holdings can lead to varied estimates. This necessitates awareness of the limitations of relying solely on public data.

In conclusion, public disclosures, when available and reliable, offer valuable insights into a person's financial position, including the net worth of an individual like Donald Trump Jr. While not a definitive measure, these disclosures provide a critical foundation for understanding wealth accumulation and economic activity. However, incomplete or absent public disclosures necessitate caution in drawing conclusions, recognizing the complexity and potential for varied estimations. The broader importance of transparency in public figures' finances is critical for maintaining public trust and promoting a more informed understanding of economic influence.

6. Estimate Fluctuations

Estimating Donald Trump Jr.'s net worth is inherently subject to fluctuations. These fluctuations stem from a variety of dynamic factors influencing the value of assets and income streams. Market volatility, changes in business performance, and the valuation complexities of various assets contribute to the inherent instability of such estimations. For instance, a downturn in the real estate market could lead to a decrease in the value of properties owned, directly impacting the estimated net worth. Similarly, shifts in the stock market, impacting investment returns, would also cause fluctuations in the overall valuation.

The significance of these fluctuations lies in recognizing the dynamic nature of wealth. A precise, static figure for net worth rarely captures the true complexity of financial standing. Real-world examples abound. Sudden market corrections or significant shifts in business performance can dramatically alter estimations. The ongoing nature of these adjustments necessitates a careful consideration of the time frame in which an estimate is made. A net worth estimate today might be significantly different tomorrow due to these fluctuations. Acknowledging the dynamic nature of estimations underscores the need for a critical understanding of the context surrounding these figures rather than treating them as static, immutable values. An informed approach involves considering the inherent variability associated with these calculations.

In conclusion, estimate fluctuations are an unavoidable component of assessing an individual's net worth. Recognizing the inherent dynamism and the influences driving these variations is crucial for a balanced perspective. While estimations offer insights, they should be viewed as snapshots in time, reflecting the current economic and market conditions that shape the overall valuation. Acknowledging these fluctuations provides context, ensuring the interpretation of such estimates is grounded in realistic understanding of their time-sensitive nature.

7. Privacy Considerations

Privacy considerations significantly impact the accessibility and accuracy of information concerning an individual's net worth, such as Donald Trump Jr.'s. The desire for privacy in financial matters is a common concern, particularly for high-profile individuals. This often leads to a lack of readily available, verifiable data, making estimations, rather than precise figures, the norm. Understanding these considerations is crucial for context when evaluating such financial profiles.

- Limited Public Disclosures

Public figures may choose not to disclose extensive financial details. This can result in a lack of transparency regarding specific investment portfolios, business holdings, and income sources. Private investments, for example, may be excluded from public records, obscuring a full picture of financial activity and the overall net worth. This is particularly relevant when considering the intricate workings of family businesses or private equity holdings.

- Confidentiality Agreements and Legal Restrictions

Confidentiality agreements and legal restrictions can prevent the public release of financial information. These restrictions might apply to business dealings, investments, or settlements, creating a barrier to full transparency. Legal requirements for maintaining privacy and confidentiality often outweigh the public's desire for detailed information, even for those in prominent positions. These protections can be designed to safeguard sensitive financial and personal information from unwanted scrutiny.

- Data Security and Privacy Concerns

Data security measures, aimed at preventing breaches, can also limit public access to financial details. Specific security protocols around financial records, intended to protect against unauthorized access and potential misuse, prevent public access to certain details. Data breaches, while infrequent, can expose private financial data and further limit transparency. The safeguarding of financial information against unauthorized access is paramount to many private individuals and corporations.

- Impact on Public Perception and Analysis

The lack of complete financial information can impact public perception and analysis. With limited access to financial records, analysis becomes more speculative. The difficulty in verifying information leads to potentially skewed or incomplete public understanding and assessment of financial activity. The lack of complete information potentially leads to a public discourse that is not fully informed, impacting perception of wealth and business dealings. Therefore, a complete picture of a person's financial activity is crucial for a balanced perspective.

In conclusion, privacy considerations significantly shape how financial information about individuals, like Donald Trump Jr., is perceived and analyzed. Limited disclosure, confidentiality agreements, and security protocols contribute to the complexity of compiling a precise, comprehensive picture of wealth. Understanding these limitations is important for assessing the information available and recognizing the potential for estimates to differ from true figures, especially in the case of highly visible, private figures.

8. Family Influence

Family influence can significantly impact an individual's financial standing. This influence extends beyond direct inheritance and encompasses various factors, including opportunities, mentorship, and access to resources. In the case of Donald Trump Jr., the family's substantial business presence and established network undoubtedly played a role in shaping his financial trajectory. This can manifest in direct involvement in family businesses, access to capital, strategic introductions, and opportunities presented through existing networks. The family's history and reputation can create a unique set of advantages and disadvantages, potentially influencing business ventures and investment choices. The broader context of the family's economic standing and history further contributes to the financial environment in which Donald Trump Jr. operates.

The interplay between family influence and net worth is complex. Direct inheritance certainly contributes to a higher starting point. However, the influence extends beyond tangible assets. Access to valuable networks, mentorship, and business knowledge fostered within a family with a strong entrepreneurial tradition can significantly impact investment decisions and business acumen. For instance, individuals raised within established business environments often have a built-in understanding of financial strategies and market dynamics, providing them with a potentially higher likelihood of success in business ventures. Conversely, family influence can also present challenges, particularly when there are expectations associated with maintaining a certain standard or reputation.

Understanding the connection between family influence and net worth is crucial for a comprehensive analysis. It provides a nuanced perspective on the factors shaping financial standing, acknowledging that personal achievement is only part of the equation. It also highlights the role of networks and opportunities that can arise through familial connections. However, relying solely on inherited advantages is not a guarantee of success. Individual effort and merit are still essential for long-term financial prosperity. In conclusion, while family influence can undoubtedly play a significant role in shaping an individual's financial trajectory, it's essential to recognize the multifaceted interplay of personal choices, market conditions, and individual effort.

Frequently Asked Questions about Donald Trump Jr.'s Net Worth

This section addresses common inquiries regarding Donald Trump Jr.'s financial standing. Information regarding net worth is often complex and subject to estimation rather than precise calculation. Various factors, including business ventures, investments, and income streams, contribute to the overall evaluation. This FAQ aims to clarify some common questions and concerns.

Question 1: What is the precise figure for Donald Trump Jr.'s net worth?

A precise figure for Donald Trump Jr.'s net worth is not publicly available. Various sources provide estimates, but these are often based on publicly accessible information and expert analysis, rather than official declarations. Significant variations exist among estimates due to the complexities of assessing private assets and income streams.

Question 2: What factors influence estimates of his net worth?

Several factors contribute to estimations of Donald Trump Jr.'s net worth, including the value of his business holdings (particularly real estate), investment portfolio, income streams (from business ventures, speaking engagements, or other sources), and any publicly disclosed financial information. Market fluctuations and the inherent complexities of private assets are critical factors in understanding why precise figures are not readily available.

Question 3: How do business ventures impact his net worth?

Success or failure in business ventures directly affects estimated net worth. Profits from successful ventures increase the valuation, while losses reduce it. The type of ventures (e.g., real estate, investments) and their performance in the market directly affect the calculations. The inherent risks and uncertainties in business operations contribute to fluctuations in the overall picture.

Question 4: What role do investments play in determining his net worth?

Investment returns are a key component in calculating net worth. The value of investments in stocks, bonds, real estate, or other assets fluctuates with market conditions, affecting the overall valuation. The success or failure of investment strategies will, in turn, affect the estimations.

Question 5: Why is there a lack of definitive public information regarding his net worth?

Limited public disclosure regarding financial matters is a common situation, especially for private figures or those who opt for a degree of privacy. Confidentiality agreements, the complexity of private holdings, and the desire for privacy all contribute to the absence of definitive public figures. These factors make precise estimations difficult and can result in variations among estimates.

In summary, evaluating an individual's net worth involves numerous complex factors and varying levels of public accessibility. Estimates are often based on available information, but a precise figure is often unattainable. Transparency and availability of financial information play a critical role in achieving a more comprehensive and reliable estimate.

This concludes the FAQ section. The next section will delve into the complexities of assessing wealth in individuals who hold significant public roles.

Conclusion

Assessing Donald Trump Jr.'s net worth necessitates a comprehensive understanding of several interconnected factors. The absence of definitive public disclosures necessitates reliance on estimations derived from various sources, including public information, industry analysis, and expert opinions. Key components influencing these estimations include the value of business holdings, particularly real estate, the performance of investment portfolios, and income streams from diverse sources. Fluctuations in market conditions, business performance, and privacy considerations contribute to the inherent variability of these estimations. Consequently, any figure presented should be viewed as an approximation rather than a precise representation of his total financial standing.

The complexities of evaluating wealth, particularly for individuals in prominent positions, highlight the limitations of readily available information. The interplay of private holdings, confidentiality agreements, and market dynamics underscores the inherent difficulties in obtaining a definitive figure. While estimations provide insights into potential financial standing, caution should be exercised in interpreting these figures. For a more complete and nuanced understanding, a critical approach, considering the limitations of available data, is crucial. Further research and analysis into publicly available information would offer greater depth to this topic. The broader implication lies in the limitations of public knowledge concerning the financial profiles of influential individuals and the challenges associated with maintaining transparency in these matters.

Article Recommendations

- Charli Xcxs Nationality Ethnicity What You Need To Know

- Decoding The Buffbunnycontroversy What You Need To Know

Detail Author:

- Name : Prof. Estelle Johnston

- Username : orlo66

- Email : hillard.gleason@wisoky.com

- Birthdate : 2000-02-03

- Address : 540 Trantow Inlet East Winnifred, NH 29964-4593

- Phone : 1-520-574-4540

- Company : Runte-Leannon

- Job : Talent Director

- Bio : Aperiam modi numquam aut. Quia laborum est tenetur sed ut maiores. Voluptate quod omnis dolor consequatur eos corrupti omnis.

Socials

instagram:

- url : https://instagram.com/rodolfo8872

- username : rodolfo8872

- bio : Voluptatem quis et quam. Ea ipsum sit sapiente est suscipit.

- followers : 1623

- following : 501

facebook:

- url : https://facebook.com/rodolfo_kuhlman

- username : rodolfo_kuhlman

- bio : Eius occaecati corrupti magnam. Corporis itaque omnis odit cum.

- followers : 3771

- following : 2948

linkedin:

- url : https://linkedin.com/in/kuhlman1993

- username : kuhlman1993

- bio : Id voluptatem in corrupti non fugit molestias.

- followers : 927

- following : 1224

twitter:

- url : https://twitter.com/rodolfo_official

- username : rodolfo_official

- bio : Voluptate autem rerum harum. Tenetur quos et delectus qui. Numquam iusto similique repudiandae est quia laboriosam voluptas.

- followers : 5478

- following : 2541

tiktok:

- url : https://tiktok.com/@kuhlman2001

- username : kuhlman2001

- bio : Iusto aspernatur et officiis quas. Animi soluta nihil ut ipsam unde voluptas.

- followers : 3091

- following : 1555