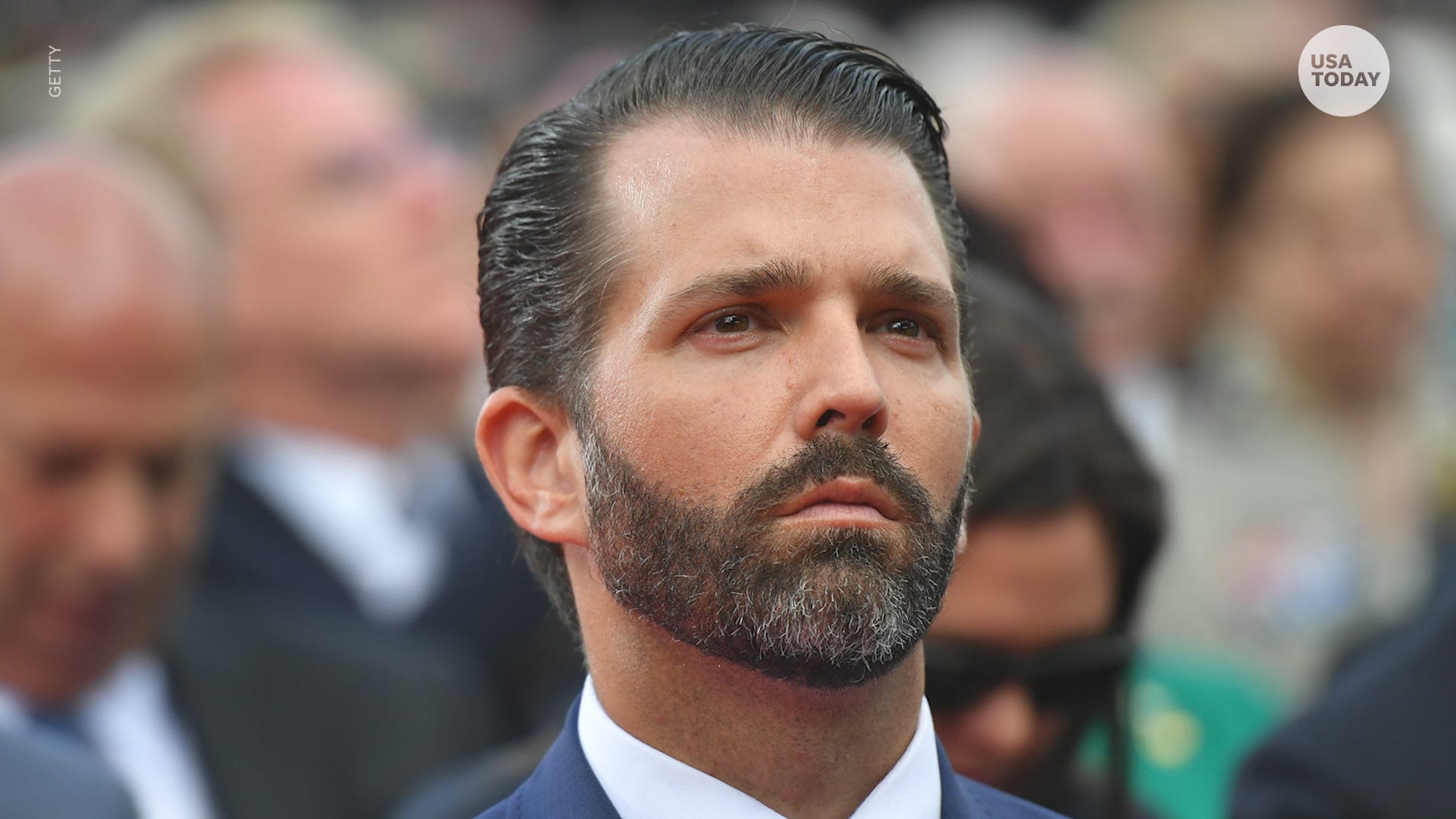

Donald Trump Jr. 2024 Net Worth: Latest Figures & Insights

Estimating the financial standing of Donald Trump Jr. in 2024 reveals a complex picture of entrepreneurial ventures and inherited assets. A precise figure remains elusive, highlighting the challenges in quantifying a private individual's wealth.

The net worth of Donald Trump Jr. in 2024 is not a readily available, publicly declared figure. Information on the assets and liabilities of private individuals is often incomplete and can be affected by factors such as fluctuating market values, business valuations, and undisclosed debts. While various sources might offer estimates, confirming these estimations with official documentation is difficult, especially in the context of private business holdings and potentially complex financial structures.

Understanding the financial trajectory of prominent figures like Donald Trump Jr. offers insight into the dynamics of wealth accumulation, particularly within family-driven businesses and entrepreneurial activities. This information provides context for appreciating the financial realities in the realm of public figures and the challenges of assessing a person's financial standing independently and with confidence. Historical data on business success and financial activity offer a wider context for considering any particular estimate of current worth. Furthermore, understanding the potential influence of business decisions and market conditions is critical to interpreting reported or estimated values.

- Nikki Glaser Nude Watch The Leaked Video Now

- Kai Trump Date Of Birth Age Family Facts Get The Details

| Category | Details |

|---|---|

| Full Name | Donald John Trump Jr. |

| Date of Birth | December 31, 1981 |

| Profession | Businessman, Entrepreneur, Author |

| Known for | Business ventures, particularly in real estate and related fields. |

Further investigation into Donald Trump Jr.'s ventures, investments, and public statements on financial matters, when available, will provide a richer and more comprehensive overview of the potential components contributing to his overall financial situation.

Donald Trump Jr. Net Worth 2024

Assessing Donald Trump Jr.'s financial standing in 2024 requires careful consideration of various factors. This includes analyzing his business activities, investment portfolios, and potential sources of income. A precise figure remains elusive, highlighting the complexities of evaluating private wealth.

- Business Ventures:

- Investment Portfolios:

- Income Sources:

- Inherited Wealth:

- Public Statements:

- Market Fluctuations:

- Private Holdings:

- Transparency:

Precise estimations of Donald Trump Jr.'s net worth are difficult due to the private nature of his holdings and investments. Public statements regarding his financial situation often serve as limited and potentially incomplete data points. Market fluctuations significantly impact valuations, rendering any given estimate subject to change. Understanding the interplay between these elements provides context for assessing the reported or estimated value. Analysis of previous business ventures, current investments, and disclosed income sources can aid in constructing a clearer financial picture. However, the lack of complete transparency in private wealth makes definitive conclusions challenging. For example, the value of real estate holdings or investment trusts is not easily ascertained without additional documentation.

- William Devane Net Worth 2024 How Much Is He Worth

- Burna Boys Marriage Is He Married Relationship Status More

1. Business Ventures

Business ventures significantly influence Donald Trump Jr.'s net worth. The success or failure of these ventures directly impacts the value of his assets and, consequently, his overall financial standing. For example, profitable real estate developments or successful investments in publicly traded companies would contribute positively to the estimated net worth, whereas losses or stalled projects could diminish it. The nature and scale of these ventures, whether small-scale enterprises or substantial corporations, play a critical role in the overall financial picture.

Analyzing the types of businesses Donald Trump Jr. is involved in offers clues. If focused primarily on ventures with significant capital requirements, such as real estate or financial investment, this suggests a larger potential financial footprint compared to smaller-scale businesses. Understanding the financial structure of these ventures, including their profit margins, debt levels, and revenue streams, further clarifies their influence on the overall financial picture. Examples from other business contexts, such as analysis of successful venture capital firms, underscore the substantial effect a well-managed business venture can have on individual wealth and demonstrate the importance of financial stability. A strategic understanding of business principles is crucial for evaluating this aspect of a person's net worth.

In conclusion, business ventures represent a key component in estimating Donald Trump Jr.'s net worth. Their performance, size, and nature all contribute to the overall financial picture. However, the complexity of private business operations and the absence of publicly available financial statements often make precise estimation challenging. A comprehensive understanding requires access to detailed information, which remains a challenge for individuals whose business activities are not publicly disclosed. Assessing the link between business ventures and net worth is critical, but the specifics of this relationship often remain opaque in the absence of full disclosure.

2. Investment Portfolios

Investment portfolios are a crucial component in determining an individual's net worth, particularly when considering figures like Donald Trump Jr. The value of these investments fluctuates with market conditions, making a precise estimate of their current worth challenging. Portfolio composition, including asset allocation and diversification strategies, plays a significant role in the overall financial picture.

- Asset Allocation:

The proportion of different asset classes within the portfolio, such as stocks, bonds, real estate, and alternative investments, impacts the overall return and risk profile. A portfolio heavily weighted toward high-growth equities, for example, may yield higher returns but also face greater volatility than a portfolio emphasizing stability with a higher allocation to fixed-income securities. The specific allocation choices reflect the investor's risk tolerance and investment goals, factors that vary significantly.

- Diversification:

Diversification aims to reduce portfolio risk by spreading investments across various sectors and asset types. A well-diversified portfolio mitigates the impact of poor performance in a particular sector or asset class. An investor heavily concentrated in a single industry or asset type faces significantly greater risk compared to one with a more diversified portfolio. Understanding the level of diversification provides insights into the potential for overall portfolio stability and resilience.

- Market Conditions:

Current market conditions exert a substantial influence on investment portfolio value. Bull markets typically result in higher portfolio valuations, while bear markets can lead to significant declines. The fluctuating nature of market conditions necessitates ongoing evaluation of portfolio holdings and strategies to adapt to changing market landscapes.

- Performance Metrics:

Performance metrics such as returns, yields, and capital gains offer insight into the portfolio's historical performance and potential future returns. Analysis of past performance, while not a definitive predictor, provides a degree of insight into the portfolio's effectiveness and the potential for continued gains or losses. However, market conditions and investment strategies often shift over time.

The composition and performance of Donald Trump Jr.'s investment portfolio significantly impact his overall net worth. While precise details remain often private, understanding the broad characteristics of investment portfolios, like diversification and asset allocation, provides a framework for assessing the potential contribution of these elements to the estimated figure. The effect of market conditions and historical performance trends on overall portfolio valuation should also be considered. Without access to detailed information, determining the exact influence on his net worth remains complex and subject to estimation.

3. Income Sources

Income sources directly influence Donald Trump Jr.'s net worth in 2024. The nature and magnitude of income streams significantly impact the overall financial picture. Consistent and substantial income from various sources contribute positively to a larger net worth. Conversely, reduced or fluctuating income streams can lead to corresponding changes in the estimated net worth. Understanding the types and amounts of income received is essential for evaluating the current financial standing. For example, substantial royalties from published works or high-revenue business ventures directly contribute to the overall net worth and financial health.

Specific income sources for Donald Trump Jr. are not readily available. However, a general framework allows for understanding the potential influences. For instance, entrepreneurial ventures, including business ownership, are a potential source. Investment income from various holdings, such as stocks, bonds, or real estate, contributes to the overall financial portfolio. Salary from employment, if applicable, also factors into the calculation. The relative contribution of each income source to his overall net worth in 2024 is likely complex and not publicly stated. Further analysis would require access to detailed financial records, which remain inaccessible in most cases. The complexity of assessing income sources often increases with the involvement in multiple businesses or investment opportunities.

In summary, income sources are fundamental to understanding Donald Trump Jr.'s net worth in 2024. Precise quantification of each contribution is challenging due to the lack of publicly accessible financial data. Examining income streams, however, provides insight into the potential components influencing the overall financial status. A comprehensive understanding requires a nuanced approach, considering the complexities of private financial information and the potential impact of various income sources on the net worth calculation.

4. Inherited Wealth

The role of inherited wealth in shaping Donald Trump Jr.'s net worth in 2024 is a complex and often-unquantifiable aspect. The presence of inherited assets or financial resources from previous generations can significantly contribute to an individual's overall financial standing. This influence can manifest in various forms, including direct inheritance, access to capital through family trusts, or opportunities afforded by familial connections within business networks. The specific mechanisms and extent of this influence are often opaque due to the private nature of such arrangements.

The potential impact of inherited wealth on an individual's net worth is substantial. Initial capital infusions or advantageous business connections can be powerful catalysts for growth. However, the inherited wealth component is not always straightforward. It may be tied to complex financial instruments, trusts, or other structures that impact the immediate availability of resources. Moreover, the effective use or mismanagement of these resources also plays a crucial role. Examples from other families with substantial inherited wealth illustrate that inherited resources can be either a significant asset in building wealth or can be eroded by poor investment strategies or mismanagement. This highlights the critical importance of sound financial management, regardless of the initial capital base. In the case of Donald Trump Jr., understanding the specific nature of inherited assets and how they were managed or reinvested is crucial to assess their precise contribution to his 2024 net worth.

In conclusion, inherited wealth constitutes a significant, albeit often opaque, component of Donald Trump Jr.'s potential net worth in 2024. The influence of these resources hinges on how they are employed and managed. This reinforces the importance of disentangling the impact of inherited wealth from other income streams, business ventures, and personal investment efforts to fully assess his current financial position. A thorough understanding of the historical context, specifics of inherited assets, and their subsequent use or investment strategy is essential to achieving a clear understanding of its contribution. Ultimately, separating this influence from other factors presents a challenge for evaluating Donald Trump Jr.'s overall financial standing, given the complexity of private wealth structures.

5. Public Statements

Public statements made by Donald Trump Jr. can offer some insights, though often indirect, into aspects of his financial situation and related activities. Statements about business ventures, investments, or financial dealings can provide context, albeit not definitive proof, regarding his overall wealth. The reliability and accuracy of these statements are critical factors in their usefulness for assessing his net worth.

- Statements on Business Ventures:

Public statements regarding business ventures can offer glimpses into the nature and scale of his business activities. Announcements about new projects, expansion plans, or significant partnerships might indicate investment strategies or potentially highlight revenue streams that could influence the overall financial picture. However, these statements should be considered in conjunction with other evidence, as they rarely provide precise financial details or valuations. For example, a statement announcing a major new real estate development might indicate a large-scale financial undertaking but wouldn't immediately yield a quantifiable impact on net worth.

- Financial Disclosure in Public Forums:

Public appearances or interviews where Donald Trump Jr. discusses financial matters, if any, can offer information regarding his assets, investments, or income sources. Such statements, however, would likely be broad observations rather than precise valuations. The level of detail provided in these contexts would vary, and the accuracy of disclosures needs careful consideration. Publicly disclosed financial documentsif any existprovide more reliable information.

- Implications for Evaluating Net Worth:

Public statements, while offering potentially helpful context, should not be relied upon as definitive indicators of Donald Trump Jr.'s net worth. Statements are often broad generalizations and lack the specificity needed for precise financial calculations. The context surrounding statements (market conditions, economic trends) also requires consideration. Care must be taken to avoid drawing firm conclusions about net worth solely based on public statements.

- Comparison to Transparency Standards:

Public figures, especially those engaged in substantial business activity, often face expectations of financial transparency. The lack of detailed and consistent financial disclosure in Donald Trump Jr.'s public statements, when compared to other entrepreneurs in comparable situations, suggests complexities that need careful consideration. The absence of readily accessible financial statements and the nature of private holdings present challenges in precisely assessing net worth.

Ultimately, public statements offer only a limited and often indirect view of Donald Trump Jr.'s financial status. Their usefulness as a source of information regarding his net worth is significantly constrained by the absence of definitive financial details. Additional, verifiable financial data is critical to achieve a comprehensive and reliable assessment of his financial position in 2024.

6. Market Fluctuations

Market fluctuations significantly impact estimations of Donald Trump Jr.'s net worth in 2024. The value of assets, including investments and potentially real estate holdings, is highly sensitive to market conditions. Changes in stock prices, interest rates, and broader economic trends directly influence the overall valuation of his portfolio.

- Stock Market Volatility:

Fluctuations in stock market indexes, such as the S&P 500, directly affect the value of publicly traded companies and investment portfolios. If Mr. Trump Jr. holds stock investments, significant market downturns can decrease the value of his holdings. Conversely, rising markets may increase the value of those holdings. The specific impact depends on the portfolio's composition and diversification strategies. For instance, a portfolio heavily invested in a specific sector susceptible to a downturn would experience greater negative impacts compared to a more diversified one.

- Real Estate Market Cycles:

Real estate values are sensitive to economic conditions. Recessions or periods of economic uncertainty often lead to decreased demand and, consequently, lower property values. Conversely, periods of economic growth and low interest rates typically boost real estate markets. If Mr. Trump Jr. has substantial real estate holdings, the state of the real estate market would influence the overall valuation of his assets. For example, a decline in the luxury real estate market would negatively impact the value of high-end properties in his portfolio.

- Interest Rate Movements:

Interest rate changes affect borrowing costs and investment returns. Higher interest rates typically increase borrowing costs for businesses and individuals, potentially impacting the value of loans or debt instruments. Conversely, lower interest rates may stimulate investment but also affect returns on fixed-income investments. For Mr. Trump Jr., this factor could significantly influence the valuation of his holdings based on the structure of investments. For example, if he has investments in mortgage-backed securities or bonds, changes in interest rates will influence those investments' value.

- Economic Growth and Uncertainty:

Broad economic trends, such as overall growth, inflation, and unemployment rates, influence investor sentiment and asset prices. Periods of strong economic growth typically provide a positive backdrop for asset valuations, whereas uncertainty can lead to volatility and reduced confidence. This broader macroeconomic context will heavily impact the evaluation of an individual's wealth in a dynamic market setting. For instance, high inflation may negatively impact the real return of certain investments.

In conclusion, market fluctuations represent a dynamic and significant factor in assessing Donald Trump Jr.'s net worth. The value of his assets is closely tied to these market movements. A precise evaluation requires a detailed analysis of his portfolio, accounting for various factors such as asset allocation, diversification, and the specific nature of his investments. The complexity of these relationships makes a definitive evaluation challenging without detailed information.

7. Private Holdings

A crucial aspect of estimating Donald Trump Jr.'s net worth in 2024 involves understanding the nature of his private holdings. These holdings, often not publicly disclosed, can significantly influence the overall financial picture, potentially representing a substantial portion of his total wealth. The complexity and opacity of private assets present inherent challenges in accurately determining their value.

- Real Estate Holdings:

Properties, particularly high-value real estate, frequently constitute a significant portion of private wealth. Valuations of these properties can be complex, depending on factors such as location, size, condition, market trends, and potential for future appreciation. Precise valuations for private holdings often depend on comparable sales and expert appraisals, which are not always publicly available. Variations in real estate markets across regions and sectors introduce further complexities.

- Investment Vehicles:

Private investment vehicles, including limited partnerships or private equity funds, can hold substantial value but are often not publicly traded. The valuation of these holdings often depends on complex internal accounting procedures, projections, and potential exit strategies. The lack of readily available market data makes estimates inherently uncertain. A lack of established market parameters and infrequent trading further complicates determining the precise value.

- Business Interests:

Private businesses and ownership stakes in privately held companies present another category of significant private holdings. Determining the value of these businesses typically involves independent valuations, often based on factors like projected earnings, revenue streams, and market comparables for similar companies. Determining the accurate market value for privately held businesses often relies on specialized valuation techniques and expert analysis.

- Impact on Valuation:

The presence of significant private holdings influences the overall estimation of net worth. Because these holdings are frequently not subject to the same level of public scrutiny as publicly traded assets, accurately assessing their value requires specialized knowledge and analysis, often with substantial limitations. The complexity inherent in private asset valuations makes direct comparison to other public figures' wealth estimations less straightforward. The challenges of determining valuation for private holdings reinforce the significance of considering their existence as a key component in the larger picture.

In conclusion, private holdings, encompassing real estate, investment vehicles, and business interests, can significantly influence Donald Trump Jr.'s net worth in 2024. The inherent opacity of these holdings makes a precise and universally accepted estimate challenging. The absence of transparent financial reporting, coupled with the complexities of valuing private assets, emphasizes the limitations in providing a definitive figure without access to detailed, confidential information.

8. Transparency

The concept of transparency is crucial when assessing a figure like Donald Trump Jr.'s net worth in 2024. Without transparency, an accurate valuation becomes significantly more challenging. Transparency, in this context, refers to the openness and accessibility of financial information regarding business dealings, investments, and assets. The lack of this transparency creates a substantial hurdle for determining a precise net worth. The absence of public financial statements or readily available details makes the process of estimating significantly more complex. The availability of detailed, verifiable financial information is fundamental to building confidence in estimations.

Consider the impact of a lack of transparency on the broader understanding of net worth. If a substantial portion of an individual's wealth is tied up in privately held companies or complex investment vehicles, accurate assessment becomes difficult. Market valuations often depend on publicly available information. The absence of such data for private holdings necessitates reliance on estimates, which are inherently susceptible to error. The lack of transparency contrasts with publicly traded companies, where regular financial filings provide a clearer picture of financial health and market value. The discrepancy highlights the significant difference between evaluating publicly and privately held assets and the impact this discrepancy has on estimations. A lack of public disclosure also affects the ability to conduct meaningful comparisons between various individuals' wealth, as a lack of transparent data hinders comprehensive analysis. Furthermore, without transparency, assessing the potential influence of market conditions on the net worth becomes significantly more speculative. For instance, fluctuations in the real estate market, a potential source of significant wealth, remain difficult to analyze without transparency.

In conclusion, the absence of transparency concerning Donald Trump Jr.'s financial affairs significantly hinders a precise assessment of his net worth in 2024. The lack of easily accessible financial data necessitates reliance on estimates, which introduce inherent uncertainties. This lack of transparency complicates comparisons with other individuals and obscures the overall impact of market forces. A greater degree of transparency, in the form of publicly available financial statements or disclosures, would greatly enhance the accuracy and reliability of any net worth estimate. This fundamental principle applies to all wealth assessments, underscoring the vital role of transparency in the valuation process.

Frequently Asked Questions about Donald Trump Jr.'s Net Worth (2024)

Estimating the net worth of prominent individuals, especially those involved in private business ventures, presents inherent challenges. This FAQ section addresses common inquiries regarding Donald Trump Jr.'s financial standing in 2024, acknowledging the complexities and limitations in providing definitive figures.

Question 1: What is the precise net worth of Donald Trump Jr. in 2024?

A precise figure for Donald Trump Jr.'s net worth in 2024 is not publicly available. Estimating private wealth is inherently more complex than assessing publicly traded assets. Factors such as the value of real estate holdings, investments in private companies, and the potential for fluctuating market conditions make a definitive statement difficult.

Question 2: What sources of income contribute to Donald Trump Jr.'s financial position?

Donald Trump Jr.'s income likely stems from various sources, including business ventures, investments, and potentially, royalties or other forms of compensation. Details regarding the specific contributions from each source are not publicly available, and therefore remain uncertain. Assessing the relative weight of each income stream in shaping his overall financial position is also challenging.

Question 3: How do market fluctuations affect estimates of Donald Trump Jr.'s net worth?

Market fluctuations, including changes in stock prices, interest rates, and economic conditions, significantly influence asset valuations. Fluctuations can affect the value of publicly traded or privately held investments. The impact of these changes on Mr. Trump Jr.'s net worth is not easily quantifiable due to the lack of transparency regarding his specific holdings. The correlation between market movements and his estimated net worth is uncertain, relying on assumptions.

Question 4: How does inherited wealth potentially affect Donald Trump Jr.'s net worth?

Inherited wealth can potentially play a significant role in an individual's financial standing. The impact of inherited assets on Donald Trump Jr.'s overall net worth, however, remains unclear without detailed information. The nature and management of inherited assets and their subsequent reinvestment are complex and often private, limiting the ability to assess their precise contribution to his current position.

Question 5: Why is precise net worth estimation difficult in the case of Donald Trump Jr.?

Estimating the net worth of an individual with primarily private holdings, like Donald Trump Jr., poses inherent challenges. The opacity of private investment portfolios, business ventures, and other forms of wealth makes it hard to build a complete and accurate picture. This lack of transparency, alongside the dynamic nature of market values, significantly limits the possibility of providing a definitive figure.

In summary, while various factors can contribute to a person's wealth, determining a precise net worth for Donald Trump Jr. in 2024 remains challenging due to the complex interplay of market conditions, private holdings, and the limited availability of complete financial information. Estimating wealth requires considerable research and analysis. This FAQ provides a framework for understanding the inherent complexities of such estimations.

Moving forward, analysis of publicly available information related to Mr. Trump Jr.'s business activities can provide additional context. The potential for future financial disclosures, if any, may further illuminate this topic.

Conclusion

Assessing Donald Trump Jr.'s net worth in 2024 necessitates acknowledging the inherent complexities of evaluating private wealth. The absence of publicly available financial statements, combined with the inherent opacity of private holdings, presents a significant hurdle to precise valuation. Key factors influencing estimation include the value of real estate assets, the performance of investment portfolios, the success of business ventures, and the potential impact of inherited wealth. Market fluctuations, a dynamic force in asset valuation, introduce further uncertainty. While various sources might offer estimates, a definitive figure remains elusive without comprehensive financial disclosures. Public statements, while potentially offering contextual clues, lack the specificity required for precise calculations.

The lack of transparency surrounding Donald Trump Jr.'s financial affairs underscores the broader challenges in assessing private wealth. This case highlights the limitations of estimating the net worth of individuals whose financial activities remain largely private. Future analysis may benefit from improved transparency in financial reporting, though a precise valuation may remain unattainable. Understanding the complexities of private wealth estimation is crucial for interpreting related information, acknowledging the substantial differences between evaluating private and public assets. A thorough understanding of the underlying principles and limitations surrounding private wealth valuation is essential for informed interpretation of any available data on this topic.

Article Recommendations

- Carly Jane Onlyfans Leak A Critical Look At Privacy Content Risks

- Sofia Carson Explore Pics Videos But Be Warned

Detail Author:

- Name : Dina Breitenberg

- Username : reichel.jolie

- Email : macie00@yahoo.com

- Birthdate : 1991-10-29

- Address : 305 Bradtke Summit Suite 358 Bashiriantown, IA 42721-7043

- Phone : 1-279-452-6457

- Company : Corwin-Becker

- Job : Postal Service Mail Sorter

- Bio : Et nisi molestiae pariatur. Consequatur facere ipsa non incidunt facilis incidunt. Labore dolores repellendus consequatur voluptatem saepe nulla.

Socials

tiktok:

- url : https://tiktok.com/@jodie_o'conner

- username : jodie_o'conner

- bio : Molestias ratione aut aperiam nesciunt sint.

- followers : 6723

- following : 2140

linkedin:

- url : https://linkedin.com/in/jodie_o'conner

- username : jodie_o'conner

- bio : Dicta libero velit accusamus a voluptas id.

- followers : 3867

- following : 2590

twitter:

- url : https://twitter.com/jo'conner

- username : jo'conner

- bio : Vel ad est non illum nisi odio. Cupiditate cum nesciunt fugiat id vel quam. Facilis deserunt laborum et tenetur iusto ut. Id blanditiis hic ad qui.

- followers : 3444

- following : 1678

facebook:

- url : https://facebook.com/jo'conner

- username : jo'conner

- bio : Odit accusantium sit rem similique natus non assumenda.

- followers : 6887

- following : 264