Spartanburg County Tax Records: Find & Access Info | SC

Are you navigating the often-complex world of property taxes and public records in Spartanburg County, South Carolina? Understanding the intricacies of property assessments, tax payments, and accessing essential documents is crucial for every property owner and resident.

Finding accurate information can sometimes feel like searching for a needle in a haystack. The official website for Spartanburg County provides a quick view of essential information for public users, but the details can often be scattered across different departments and online portals. This article serves as a comprehensive guide, providing you with the necessary tools and insights to navigate the landscape of Spartanburg County's public records, tax assessments, and property-related services. Whether you're a seasoned property owner or a newcomer to the area, this information is designed to clarify the procedures, point you toward the right resources, and help you understand your rights and obligations.

Let's delve into the specifics of accessing critical services and information.

- Nicky Gile Onlyfans Leaks What You Need To Know

- Deepfake Insights Missing Celebs A Deep Dive Into The Tech

Spartanburg County Public Records and Tax Information

Spartanburg County, South Carolina, offers various online resources for accessing public records and managing property tax-related matters. These resources are essential for anyone seeking information about property ownership, tax payments, and assessments. This guide provides an overview of the key services, departments, and online portals available to the public.

Accessing Public Records

Navigating the maze of public records can be overwhelming. Here's how to get the information you need.

- Tax Record Lookup: A key service allowing users to find tax records within Spartanburg County. This is often the first step in finding any property related information.

- Document Retrieval: Accessing important documents is simplified through available retrieval services.

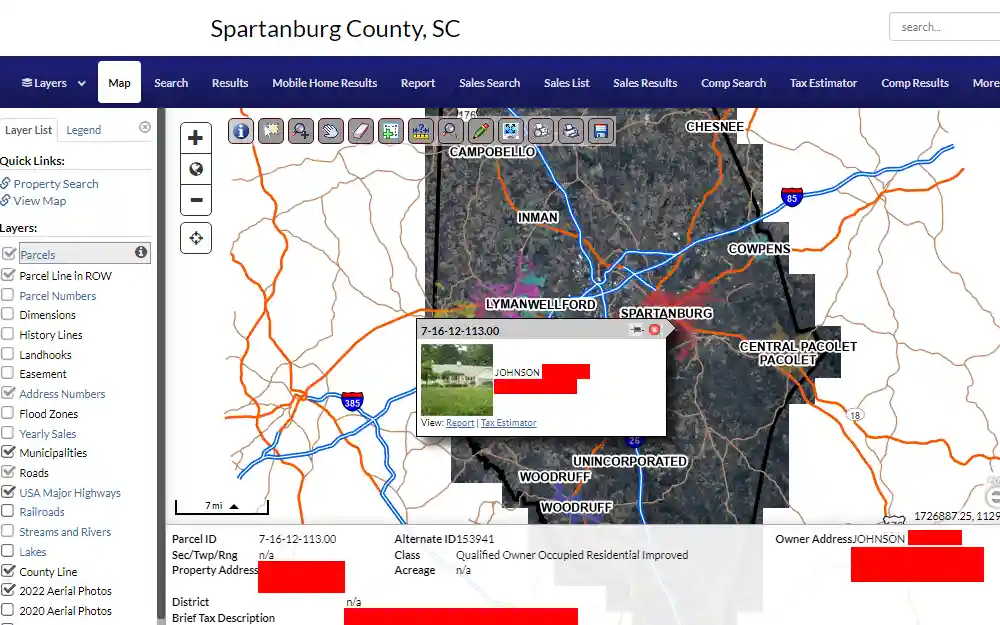

- Property Records Search: Use the online lookup tools to discover various details regarding property records, which include but are not limited to ownership, property lines, and property values.

- Register of Deeds Records Search: The Register of Deeds maintains records of deeds and plats.

- AcreValue: AcreValue provides a valuable online platform for finding property lines, and ownership details. It simplifies the process of accessing information typically found in plat books by offering an easily searchable digital interface. It shows property boundaries for each parcel of land.

Tax Assessment and Payment Information

Understanding and managing property taxes is a fundamental aspect of property ownership.

- Property Assessments: The Spartanburg County Tax Assessor is responsible for assessing the value of all properties. These assessments determine the amount of tax due.

- Tax Payments: Information on how to pay property taxes is available through the countys online portals.

- Tax Payments Portal: Online portals allow easy and efficient tax payments.

- Spartanburg County Treasurer: This elected official collects and manages the disbursement of taxes.

Key Departments and Contacts

Knowing which department to contact is crucial for effective communication.

- Spartanburg County Assessor's Office: Responsible for property valuation. Contact for any queries relating to property valuation.

- Spartanburg County Treasurer's Office: Handles tax collection and disbursement. Reach out to them if you have questions about payment.

- Spartanburg County Mapping Department: The mapping department can be reached by contacting the assessors office at PO Box 5762, Spartanburg, SC 29304, or via email.

- Register of Deeds: Serves for Deeds and Plats.

Online Resources and Portals

The county provides a range of online tools.

- Online Property Search: Available for searching property details.

- Online Tax Payment Portals: Enables easy and convenient tax payments.

- NETR Online: For searching public records and property tax information.

- South Carolina Tax Guide: For additional tax information.

Important Considerations

- Contact the Right Office: Ensure youre contacting the correct office when inquiring about property taxes.

- Taxing Entities: Note that no taxes are accessed by cities or towns in South Carolina; all taxes are accessed by the county.

- Gis Function: The GIS department maintains and updates addresses and streets.

For those seeking a deeper dive into these topics, heres a more structured presentation of essential information:

| Category | Details |

|---|---|

| Primary Resources |

|

| Online Search Tools |

|

| Key Contacts |

|

| Legal and Regulatory Context |

|

| Additional Services |

|

Important note: Always double-check all official sources and verify the information with the appropriate county departments.

By utilizing these resources and understanding the key departments involved, residents of Spartanburg County can successfully navigate the complexities of property taxes and public records. Remember to always verify information directly with the relevant county offices for the most accurate and up-to-date details.

Article Recommendations

Detail Author:

- Name : Carmela Dach

- Username : rpadberg

- Email : johns.chase@yahoo.com

- Birthdate : 1998-11-17

- Address : 17890 Duncan Village West Noemychester, HI 86627

- Phone : +1-704-923-4692

- Company : Franecki, Graham and Gusikowski

- Job : Architectural Drafter

- Bio : Id enim magnam similique at animi dolorem. Rerum voluptatem dolorem perferendis modi repellendus aut. Ut eum ducimus cumque.

Socials

linkedin:

- url : https://linkedin.com/in/murrayr

- username : murrayr

- bio : Deserunt nostrum rerum nesciunt vitae quo animi.

- followers : 1625

- following : 1091

twitter:

- url : https://twitter.com/ressie.murray

- username : ressie.murray

- bio : Aut ut beatae autem. Corporis vel aut minima inventore alias. Laborum quis blanditiis laborum quos ut quidem. Est modi quam est quisquam et voluptas.

- followers : 4083

- following : 681

instagram:

- url : https://instagram.com/ressie2920

- username : ressie2920

- bio : Possimus eaque aliquam non enim. Ullam id aut repudiandae inventore.

- followers : 6611

- following : 553